Why industry needs to start focussing on clean ammonia

The events of last year stressed the importance to lower the dependency of (Russian) fossil fuels. As a counteractive measure the EU’s Hydrogen Strategy and REPowerEU plan have put forward frameworks to support the uptake of renewable and low-carbon hydrogen. Ultimately, this will help decarbonise the EU in a cost-effective way and reduce its dependence on imported fossil fuel. The European Commission has proposed to produce 10 million tonnes of renewable hydrogen by 2030 and to import 10 million tonnes by 2030.

In addition to availability, another key topic of renewable hydrogen is transport. The technologies that enable the transport of commercially viable quantities of hydrogen in bulk are still in developmental phases. This is because hydrogen is a challenging commodity to safely transport due its low volumetric density and flammability. A common misconception is that the transport equipment designed to carry Liquified Natural Gas (LNG) could be easily adapted for hydrogen, but this is definitely not the case.

To tackle this issue the industry is looking for attractive alternative pathways. In this context, there is more and more attention for the hydrogen derivative – ammonia. Traditionally, the industry has perceived this agricultural chemical as more convenient to store and transport.

What is ammonia?

In order to better understand interest, it is important to know a bit more about the industrial trajectory of ammonia.

Ammonia (NH₃) is an inorganic compound made up of hydrogen (H₂) and nitrogen (N₂). Compared to hydrogen as a fuel, ammonia is more energy efficient, and can be produced, stored, and delivered at a much lower cost than hydrogen. From that perspective hydrogen and ammonia can be competitive net zero energy sources and energy carriers for a number of applications. Until recently, the various colours of hydrogen were defined. A similar colour scheme is recurringly used to describe the carbon intensity of the different methods for making ammonia. The four types of ammonia are:

- Grey ammonia: conventional production based on the ‘Haber-Bosch’ process (natural-gas). In this process the hydrogen often comes from Steam Methane Reforming (SMR) resulting in CO2 emissions;

- Blue ammonia: ammonia produced using blue hydrogen (hydrogen produced by SMR where the carbon dioxide has been captured and stored);

- Green ammonia: ammonia produced by using green hydrogen (hydrogen produced by electrolysis);

- Turquoise ammonia: This process uses pyrolysis to convert methane into pure carbon and hydrogen, which is reacted with nitrogen to make ammonia. The industry thinks of turquoise ammonia as somewhere between green and blue.

Presently, the predominately produced ammonia is ‘grey’. Pivoting the current infrastructure towards environmentally friendly fuels will take time. Globally, about 180 million metric tonnes of ammonia is produced annually, and 120 ports are ammonia equipped terminals. Collectively, this may ease the transport and uptake of ammonia even though, for certain applications, hydrogen will remain the molecule of choice.

Also here ammonia can play a pivotal role – via ‘cracking’, which is the process of producing hydrogen from ammonia.

What is ammonia cracking?

Ammonia cracking is a reconversion process by which ammonia is decomposed back into hydrogen and nitrogen. This results in the following equation:

2NH₃ = N₂ + 3H₂

The current state-of-the art ammonia recovery systems require reaction units and catalysts operating at high temperatures (550-800°C) for complete ammonia conversion and are principally based on fired and heat transfer limited cracker design. Therefore this step is not that straightforward and requires significant R&D efforts.

However, the outlook of a renewable hydrogen value chain whereby renewable hydrogen is produced in a third country; locally converted to green ammonia; shipped via existing ammonia vessels and imported via existing terminals; cracked into hydrogen via a central large-scale ammonia cracker and injected into a hydrogen grid for end-consumer use, is despite its challenges, appealing enough for Industry to keep this route pushing forward.

What are the current challenges around ammonia use?

In order for ammonia to play a key role in decarbonising the industry, there are various bottlenecks and challenges that need to be overcome:

- Policy challenges: currently there is a lack of regulatory support, for example, illustrated in the current Trans-European Networks for Energy (TEN-E). Also the way members states will adopt EU policy and are willing to incentive ammonia is a key factor;

- Price of locally produced green hydrogen (GH₂) versus green ammonia import (GNH₃);

- Technological development: the current green ammonia technology needs to be scaled up with further innovation in electrolyser technologies and manufacturing capabilities. Also for ammonia reconversion, progress in Technology Readiness Level (TRL) must be made;

- Access to volumes: Intergovernmental agreements are still early-stage for origination and presently there are no ammonia import facilities than can accommodate non-EU imports;

- Health and Safety: High emissions from shipping use and incomplete combustion;

- Customer/public acceptance concerns – particularly around HSE.

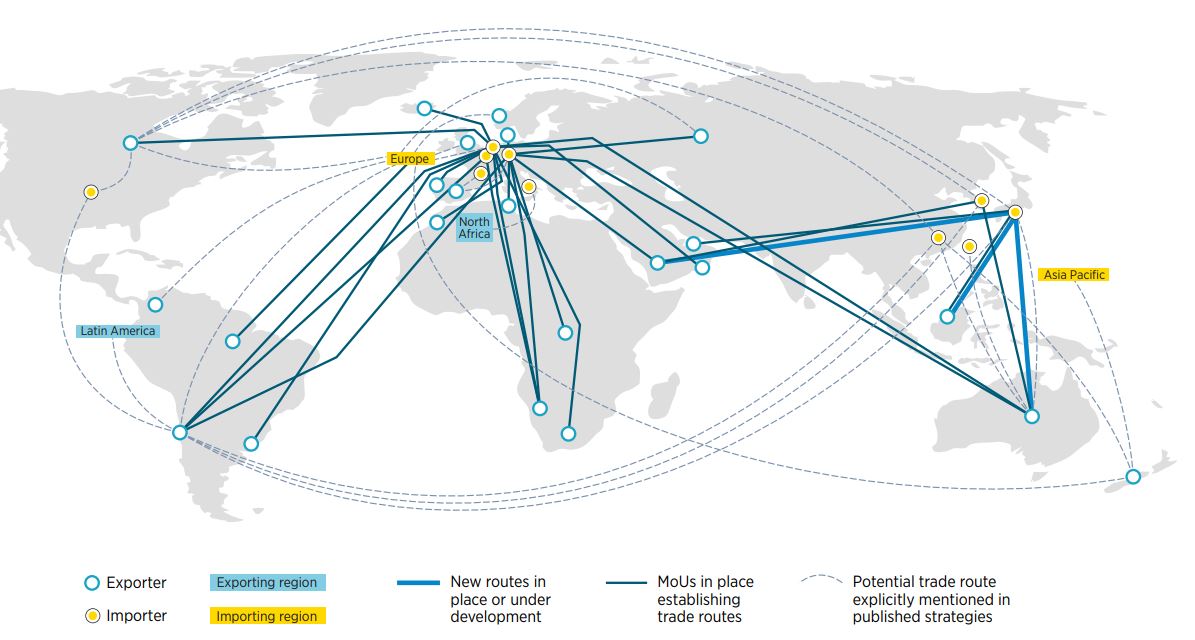

Figure 1: An expanding network of hydrogen trade routes, plans and agreements

Source: IRENA (2022a)

Conclusions

Whilst green ammonia demand and production remains in it’s infancy, demand for this hydrogen-derivative is expected to increase in the coming years due to its pivotal role in helping to decarbonise the industry. Hezelburcht has noticed a substantial push in this narrative as evidenced by the recent announcement of multiple projects by key stakeholders in the industry. Whilst the use of green ammonia has its challenges, the EU must amend the regulatory frameworks in place (TEN-E, RED III etc.,) to enable the rolling out of a green ammonia value chain in order to ensure that they may continue to meet its Hydrogen Strategy and REPowerEU ambitions.

How can Hezelburcht help you navigate these challenges?

With a proven track record of supporting projects under key energy transition umbrellas, including but not limited to: Important Projects of Common European Interest (ICPEI), Connecting Europe Facility (CEF), Projects of Common Interest (PCI) and more, Hezelburcht can help you realise your hydrogen/ammonia ambitions in the European market. Are you in need of advice? Then please do not hesitate to contact us. Feel free to contact specialist Aumar Mustafa directly at a.mustafa@hezelburcht.com. You can also contact us by filling out the form below or calling us at 088 495 20 00.